Selling Your Business

Our Objectives

Acquire profitable, well established manufacturing companies from legacy-minded business owners, support the long-term success of the businesses acquired, and create sustainable and growing shareholder returns.

Disciplined Criteria

- Disciplined acquisition strategy.

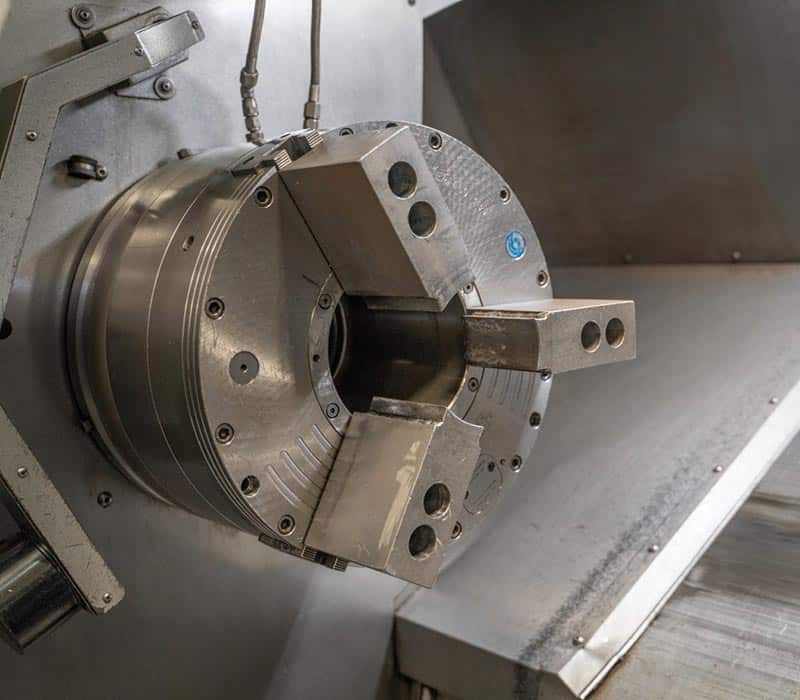

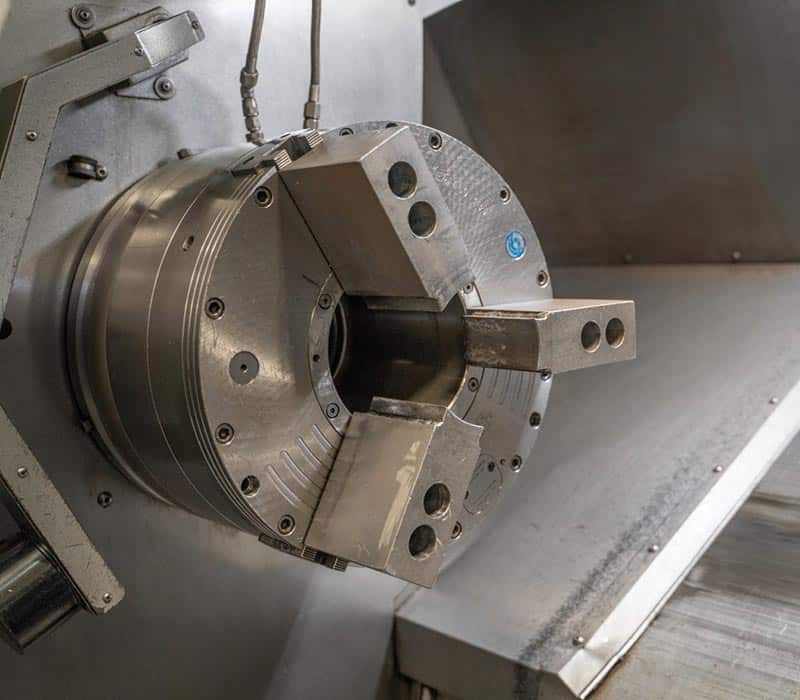

- Focus on opportunities in manufacturing.

- Steady cash flows with growth potential.

- Established, strong leadership.

- Sustainable competitive advantage.

- Operations based in North America and the United Kingdom.

- Enterprise value up to $25 million.

Approach

Buy / Build / Hold

- Acquire 100% ownership.

- Vendors and key management have equity interest.

- Provide capital to grow the business.

- Long term ownership.

Strong Partnerships

- Subsidiaries continue to operate autonomously.

- Maintain individual business identity.

- Oversight through strategic planning, financial reports, and other support.

- Partner with existing management to grow the business.

- Access to resources to help achieve business potential.

Why Decisive

Vendors

- Legacy-minded business model.

- Exit opportunity.

- Opportunity to cash out (purchase consideration: minimum 10% Decisive Dividend shares, remainder in cash).

- Participate in future Decisive Dividend growth.

Employees

- Business as usual.

- Opportunity for equity ownership (Employee Share Purchase Plan).

- Capital to grow the business.

- Stability of long-term ownership.

- Commitment to communities where businesses are located.

Shareholders

- Sustainable and growing shareholder returns.

- Monthly dividend strategy.

- Growing portfolio of companies.

- Strong deal flow.

- Industry and geographic diversification.

- Organic growth of existing companies.

If you think you’re company or situation may be of interest to us, please do not hesitate to confidentially contact us at .